The value of metallic mineral production began the year on a strong note, experiencing a 22.76 percent increase, or PhP11.84 billion, rising from PhP52.03 billion in Q1 2024 to PhP63.88 billion in Q1 2025. This growth was driven by the bullish prices of gold, silver, and copper, alongside a rise in gold and silver production.

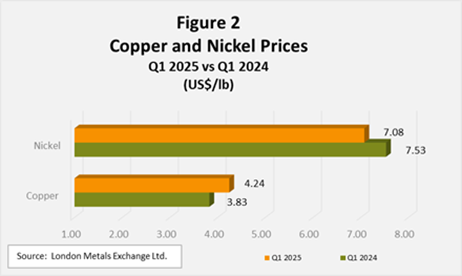

According to data from the Bangko Sentral ng Pilipinas, gold prices reached an unprecedented level of US$2,858.27 per troy ounce, up from US$2,070.05 per troy ounce the previous year—a significant increase of 38.08 percent, or US$788.22. Silver also saw substantial gains, with prices climbing 39.29 percent from US$22.85 per troy ounce to US$31.83 per troy ounce year-on-year. Copper prices rose by 10.89 percent, increasing from US$3.83 per pound to US$4.24 per pound year-on-year. In contrast, nickel prices fell slightly from US$7.53 per pound to US$7.08 per pound, mainly due to a supply glut caused by decreased demand in China stemming from geopolitical tensions and tariff disputes, combined with increased production in Indonesia. It is important to note that China accounted for 66 percent of global nickel consumption in 2024, down from 80 percent in 2023. Nickel is primarily used in stainless steel production, battery manufacturing, and renewable energy technologies.