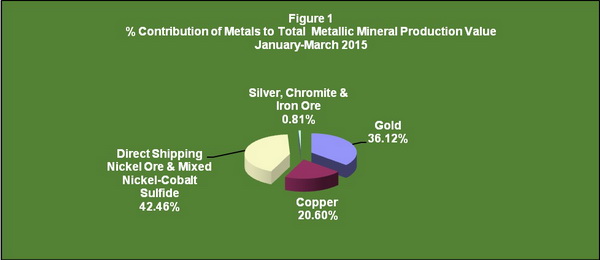

Philippine metallic mineral production value in Q1 2015 reached PhP23.72 billion up by 7.17% from PhP22.14 billion in Q1 2014, a growth of PhP1.59 billion.

Direct-shipping nickel ore and mixed nickel-cobalt sulfide were the key mineral products with a combined share of 42.46%, or PhP10.07 billion. Gold and copper followed, accounting for 36.12%, or PhP8.57 billion; and 20.60%, or PhP4.89 billion, respectively, during the review period. The combined output value of silver, chromite and iron ore was at 0.81%, or PhP0.19 billion.

The combined total production value of direct-shipping nickel ore and mixed nickel-cobalt sulfide of PhP10.07 billion is up from PhP7.83 billion in Q1 2014, a growth of 29%, or PhP2.24 billion.

The following mining projects posted the highest mine output for direct-shipping nickel ore: (1) Rio Tuba Nickel Project of Rio Tuba Nickel Mining Corporation in Palawan with 693,585 dry metric tons; (2) Claver Nickel Project of Taganito Mining Corporation in Surigao del Norte with 515,033 dry metric tons; (3) Tubay Nickel-Cobalt Project of SR Metals, Incorporated in Agusan del Norte with 434,158 dry metric tons; and (4) Toronto-Pulot Nickel Projects of Citinickel Mines and Development Corporation in Palawan with 413,147 dry metric tons.

The mine output of direct-shipping nickel ore is expected to improve further this year with the temporary lifting of the suspension order for the nickel mining operations of three Zambales mining contractors: Lnl Archipelago Minerals, Inc. on February 10, 2015; and Benguet Corporation Nickel Mines, Inc. and Eramen Mineral, Inc. on February 20, 2015. It is significant to note that said mining contractors incurred production setbacks in 2014 following the suspension orders issued by the Mines and Geosciences Bureau (MGB) due to environmental issues.

The exports of direct-shipping nickel ore to China in 2014 went up substantially from 22.27 million dry metric tons in 2013 to 26.41 million dry metric tons, an increase of 4.14 million dry metric tons, following Indonesia's raw ore export ban imposed in January 2014.

Gold is also expected to post higher mine production with the re-entry of Siana Gold Project of Greenstone Resources Corporation in Surigao del Norte to the production stream early this year. The Project reported zero production in 2014 after it was issued a Cease and Desist Order on June 6, 2013 due to the tension crack found on the embankment of its Tailings Storage Facility (TSF) No. 4. The said CDO was lifted on December 18, 2014 after the rehabilitation of its TSF Nos. 3 and 4. The company produced 363 kilograms of gold with estimated value of PhP623 million and 322 kilograms of silver with estimated value of PhP 7.64 million in Q1 2015.

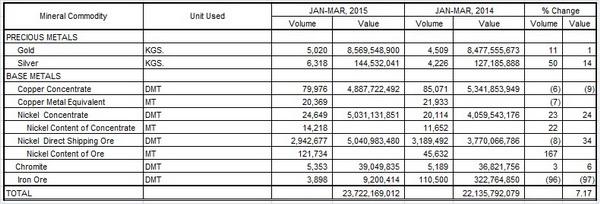

Table 1

Philippine Mineral Production

Q1 2015 vs Q1 2014

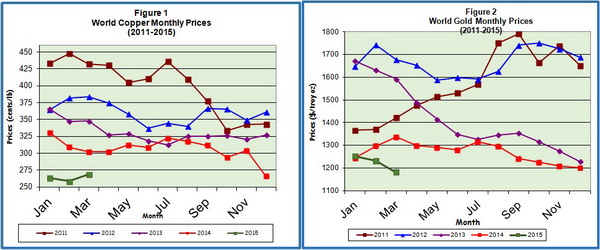

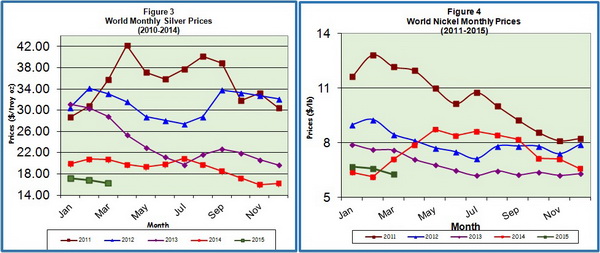

Metal prices fell in Q1 2015, with gold, silver, copper and nickel all exhibiting negative growth rates year-on-year (Figures 1-4). The sluggish price movements, particularly for base metal, were due to weaker demand, most especially from China, and supply increases/surplus in the market.

Leo L. Jasareno

Director