Metallic production value rose substantially in 2014, from PhP99.38 billion in 2013 to PhP137.53 billion during the review period, representing a 38% growth or PhP38.15 billion increase.

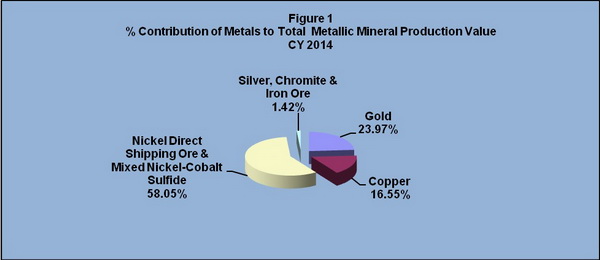

During the period, nickel (direct shipping ore and mixed nickel-cobalt sulfide) accounted for 58.05% or PhP79.84 billion of the total production value. Gold is in far second with 23.97% or PhP32.97 billion. Copper followed with 16.55% or PhP22.76 billion. Silver, chromite and iron attributed for the remaining 1.42% or PhP1.96 billion.

Direct shipping nickel ore and mixed nickel-cobalt sulfide have dominated the production scene for three years in a row. The upbeat performance of nickel was due to the entrance of new players, increased mine output and growing demand abroad. China was the prime destination of the country’s nickel ores followed by Japan. The new entrants were: 1) the Libjo Nickel Laterite Mining Project of Libjo Mining Corporation located in the Province of Dinagat Island with 10 years mine life; and 2) the Agata North Nickel Lateritic Project of TVI Resources Development Incorporated located in Agusan del Norte, with a mine life of 11 years. These new nickel mining projects are expected to boost the 2015 nickel production of the country, with the expected mine output of Libjo and Agata to be about 714,000 dry metric tons and 1,360,000 dry metric tons, respectively.

Mixed nickel-cobalt sulfide contributed about PhP20.31 billion in 2014. This was the combined output of Coral Bay Nickel Corporation (CBNC) and Taganito HPAL Nickel Corporation (THPAL), thru their hydrometallurgical nickel processing plants using the High-Pressure Acid Leach (HPAL) technology. HPAL uses sulphuric acid in high-temperature and high-pressure autoclave vessels to leach nickel and cobalt from low grade lateritic nickel ores. All the limonite ores required by CBNC are supplied by Rio Tuba Nickel Corporation while the limonite ores for THPAL come from Taganito Mining Corporation.

It is noteworthy that, the mining operations of two of the five copper mines in the country ceased in November 2013 and January 2014. The open pit mining operation of Rapu-Rapu Minerals, Inc. (RRMI) at Ungay-Malobago, in Rapu-Rapu, Albay together with the mineral processing operations of Rapu-Rapu Processing, Inc. (RRPI) in the same locality, ended in November 2013. RRMI is currently implementing its approved Final Mine Rehabilitation/Decommissioning Plan, leading to the conversion of the mined-out area into an eco-tourism site.

On the other hand, the Canatuan Mining Project of TVI Resource Development (Phils.), Inc. in Zamboanga Del Norte ended its mining operation in January 2014 after its mineral reserve was fully mined. The company is now eyeing an expansion project adjacent to its mined-out area.

Aside from copper, said companies also produced gold and silver. At the height of their operations, they were the top two silver producers in the country. In 2013, each produced more than 10,000 kilograms of silver. The substantial 43% decrease in silver output, from 40,043 kilograms in 2013 to 23,005 kilograms in 2014, was largely due to the void created by the absence of these two major players.

On a positive note, Greenstone Resources Corporation (GRC) has resumed operations in its Siana Gold Mining Project in Surigao del Norte on 18 December 2014 after the Cease-and-Desist Order (CDO) issued by the Mines and Geosciences Bureau on 6 June 2013 was finally lifted. GRC reported no production in 2014 due to the said CDO.

Table 1 PHILIPPINE METALLIC MINERAL PRODUCTION 2014 VS 2013 (As of February 2015)

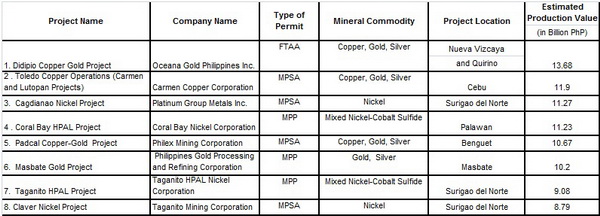

Translating the mineral production output in terms of peso value, the top eight mining projects in 2014 were the following:

FTAA - Financial or Technical Assistance Agreement MPSA - Mineral Production Sharing Agreement MPP - Mineral Processing Permit

In the international front, metal prices were less attractive in 2014, as the precious metals gold and silver, and the red metal copper all recorded negative movements during the review period. The average price of gold went down by 10.35%, from US$1,416.10 per troy ounce in 2013 to US$1,269.57 per troy ounce in 2014. Copper, likewise, declined by 7.26%, from $3.31 per pound to $3.06 per pound.

Amid the downward trend in the prices of the leading metals, nickel recorded a slight increase of 11.61% in 2014 vis-à-vis 2013, from $6.78 per pound to $7.56 per pound. Looking ahead, 2015 nickel prices are not anticipated to revert back to the double-digit levels set in 2011 given the sufficient inventory, new supplies coming on stream and weaker demand in the market, particularly involving China.

LEO L. JASARENO

Director