The Philippine metallic production value suffered a 20% deficit during the first three quarters of this year, compared to the same period last year, from PhP107.24 billion in 2014 to PhP85.78 billion this year, a PhP21.46 billion shortfall.

The soft metal prices led to the sluggish performance of the metallic minerals sector.

The world metal prices of gold, silver, copper and nickel remained lackluster during the period.

The nine-month averages for gold and silver stood at $1,180.13 per troy oz and $16.03 per troy oz, respectively. The average price of gold fell by 8.43%, from $1,288.73 per troy oz to $1,180.13 per troy oz, a difference of $108.6 per troy oz. Similarly, silver slipped by 19.64%, from $19.95 per troy oz to $16.03 per troy oz. Analysts see gold falling below the $1,100 per ounce mark before the end of 2015.

Nickel and copper prices, likewise, went down by 26.64% and 17.89%, respectively. Nickel price tumbled from $7.77 per lb to only $5.70 per lb, while copper dropped from $3.13 per lb to $2.57 per lb. The poor base metal price during the year was brought about by the listless world economic growth and slowdown of the Chinese economy.

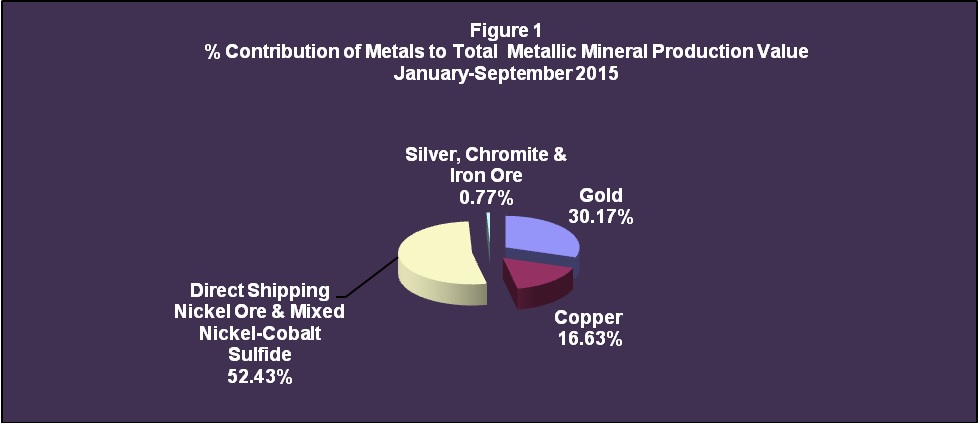

In terms of percentage contribution to the total production value, direct shipping nickel ore and mixed nickel-cobalt sulfide outpaced the others, accounting for 52.43% or PhP44.97 billion, followed by gold with 30.17%, or PhP25.88 billion. Copper, on the other hand, shared 16.63%, or PhP14.26 billion, while the remaining 0.77%, or PhP0.66 billion, came from the aggregate values of silver, chromite and iron ore.

Philippine Metallic Mineral Production

January-September 2015 vs January-September 2014

Value: In PhP

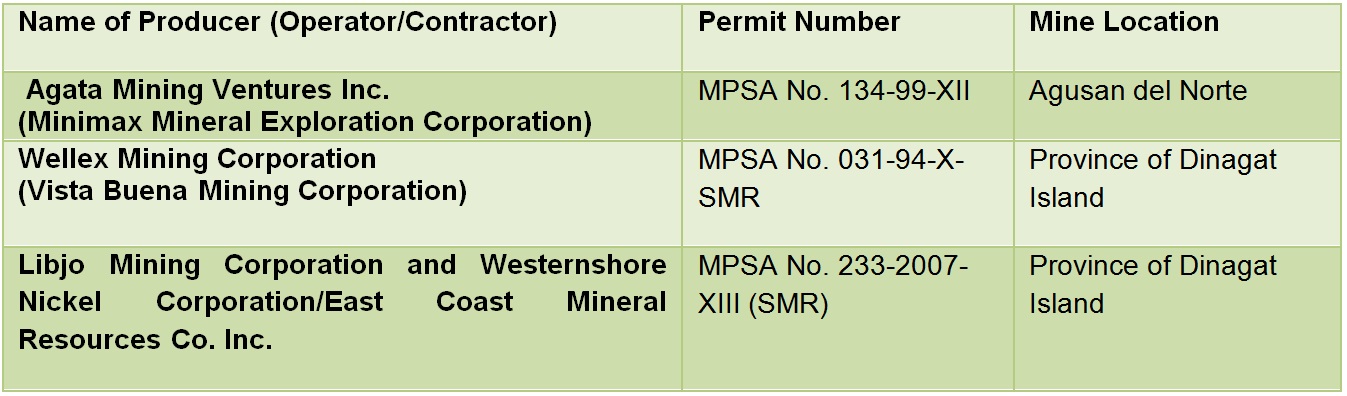

Due to the continued decrease in nickel price and lower demand for nickel ore by China, most of the country's nickel producers reduced mine production tonnage, thereby resulting in the 38% fall in the overall production value from PhP51.58 billion to PhP32.13 billion, a difference of PhP19.44 billion. Notwithstanding the present situation, four new nickel producers entered the production scene, namely:

The said new entrants accounted for 2,345,855 dry metric tons of nickel ore during the nine-month period, with estimated value of PhP2.52 billion.

The red metal suffered in both production volume and value, with setbacks of 6% and 12%, respectively; from 263,359 dry metric tons worth PhP16.17 billion to 248,593 dry metrics tons worth PhP14.26 billion.

The stoppage of mining operation at the Lutopan mining area of Carmen Copper Corporation in Toledo City, Cebu starting March 2015 was also a major factor. Momentarily, the mining operation of Carmen Copper Corporation is only at the Carmen mining area.

On a positive note, the precious metals gold and silver both exhibited growth during the nine-month period. The yellow metal enjoyed a 19% increase in volume, from 12,996 kilograms to 15,485 kilograms, an improvement of 2,489 kilograms. Correspondingly, the white metal displayed a 34% increase from 16,433 kilograms to 21,974 kilograms, or a 5,541-kilogram upsurge. The major players for the growth were the Didipio Copper-Gold Project of Oceanagold Philippines, Inc., the Masbate Gold Project of Filminera Resources, Inc., and the Maco Gold Operation of Apex Mining Co., Inc. It is noteworthy that even as economic slowdown continues around the globe, gold and silver remain as the preferred investment haven in times of economic uncertainty.

LEO L. JASARENO

Director, Mines and Geosciences Bureau