Philippine metallic mineral production value dropped by 13.59% in H1 2016 from PhP55.84 billion in H1 2015 to PhP48.25 billion, a PhP7.59 billion deficit. Suspension of mining operations, reported zero mine production and sluggish metal price movement were the key factors for this weak performance.

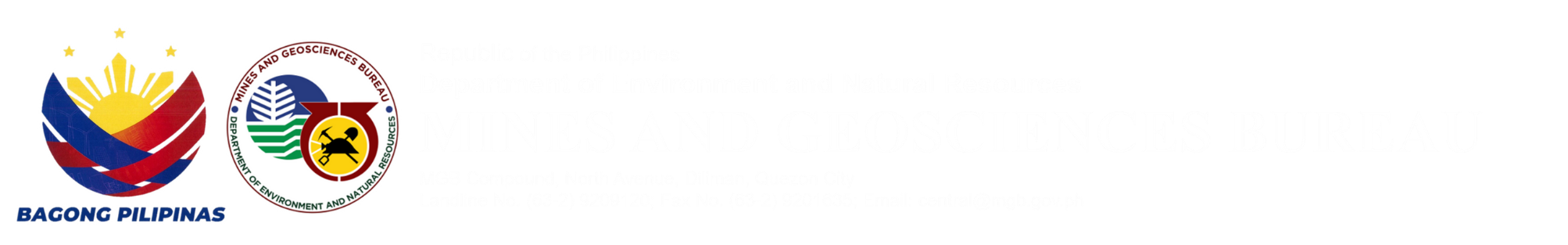

Gold made a big comeback in H1 2016 accounting for 47% or PhP22.68 billion of the total metallic production value. Since 2012 nickel direct shipping ore and mixed nickel-cobalt sulfide combined dominated the production scene. During the period, however, nickel took the second spot with 33% contribution or PhP16.08 billion; and copper with 19% or PhP9.01 billion. The remaining 1% or PhP0.47 billion, came from the collective values of silver, chromite and iron ore (See Figure 1).

In general, the poor showing of the nickel ore and nickel product producers during the period led to the lackluster performance of the metallic minerals industry. Nickel ore production suffered 30% decline from 14,880,091 dry metric tons valued at PhP19.08 billion to 10,450,659 dry metric tons valued at PhP9.20 billion, implied a 4,429,432 dry metric tons and PhP9.88 billion cutback in volume and value. While mixed nickel-cobalt sulfide output went down by 14% from 43,512 dry metric tons valued at PhP9.23 billion to 37,604 dry metric tons valued at PhP6.89 billion.

Significant developments during the period was the continued suspension of mining operations of four nickel mines in Zambales, namely: 1) Zambales Diversified Metals Corporation (Sta. Cruz-Candelaria Mining Project); 2) BenguetCorp Nickel Mines Inc. (Sta. Cruz Nickel Mining Project); 3) Eramen Minerals Inc. (Sta. Cruz Mining Project); and 4) LNL Archipelago Minerals Inc. (Sta. Cruz Mining Project).

Adding to the woes of nickel, was the reported zero production of Wellex Mining Corporation (Wellex Area II Nickel Mining Project), Oriental Vision Mining Phils. Corporation (Palhi Nickel Project) and Westernshore Nickel Corporation (Libjo Project-Phase 2) due to poor metal price and on-going care and maintenance works during the period. All three companies are located in Dinagat Island in Mindanao and are only into their second year of commercial operation.

Still on nickel, major producers like Rio Tuba Mining Corporation in Palawan, Taganito Mining Corporation in Surigao Del Norte, Platinum Group Metals Corporation in Surigao del Norte and SR Metals Inc. in Agusan Del Norte all incurred production setback both in volume and value.

Table 1. Philippine Metallic Mineral Production, H1 2016 vs H1 2015

Value: In PhP

|

Mineral Commodity |

Unit Used |

JAN-JUN, 2016 |

JAN-JUN, 2015 |

% Change |

|||

|

Quantity |

Value |

Quantity |

Value |

Quantity |

Value |

||

|

PRECIOUS METALS |

|||||||

|

Gold |

KGS. |

12,191 |

22,679,145,662 |

10,261 |

17,359,601,063 |

19 |

31 |

|

Silver |

KGS. |

20,316 |

433,282,454 |

13,983 |

314,017,585 |

45 |

38 |

|

BASE METALS |

|||||||

|

Copper Concentrate |

DMT |

177,679 |

9,010,834,967 |

162,967 |

9,605,675,178 |

9 |

-6 |

|

Copper Metal Equivalent |

MT |

44,813 |

41,878 |

7 |

|||

|

Mixed Nickel-Cobalt Sulfide |

DMT |

37,604 |

6,889,404,412 |

43,512 |

9,234,554,025 |

-14 |

-25 |

|

Mixed Nickel-Cobalt Sulfide (Metal) |

MT |

21,673 |

25,151 |

-14 |

|||

|

Nickel Direct Shipping Ore |

DMT |

10,450,659 |

9,195,628,843 |

14,880,091 |

19,076,508,016 |

-30 |

-52 |

|

Nickel Content of Ore |

MT |

127,435 |

194,043 |

-34 |

|||

|

Chromite |

DMT |

3,894 |

29,281,376 |

12,464 |

90,922,826 |

-69 |

-68 |

|

Iron Ore |

DMT |

6,549 |

12,273,594 |

70,068 |

157,343,684 |

-91 |

-92 |

|

TOTAL |

48,249,851,308 |

55,838,622,379 |

-13.59 |

||||

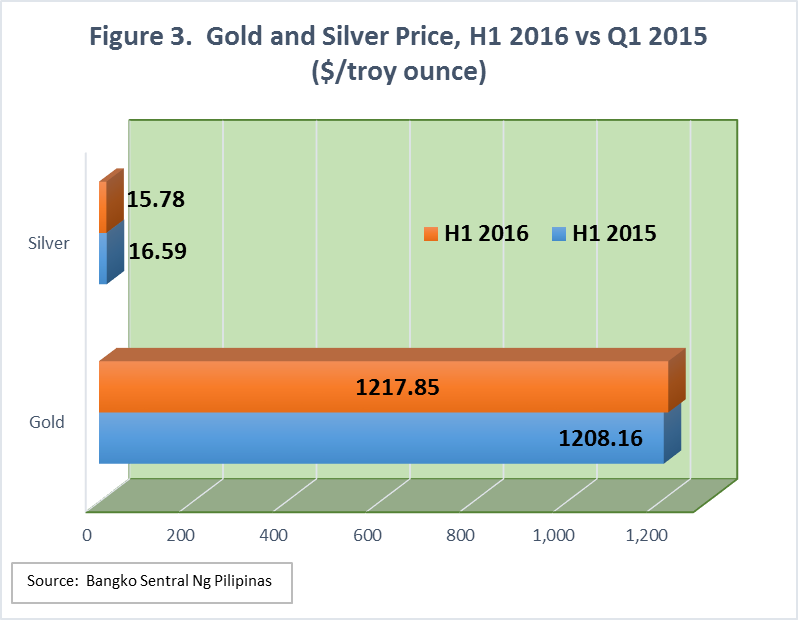

On metal prices, precious metal silver, and the base metals copper and nickel, all recorded downward trend during the period. The average price of silver registered a decline of almost 5% from $16.59 per troy ounce to $15.78 per troy ounce.

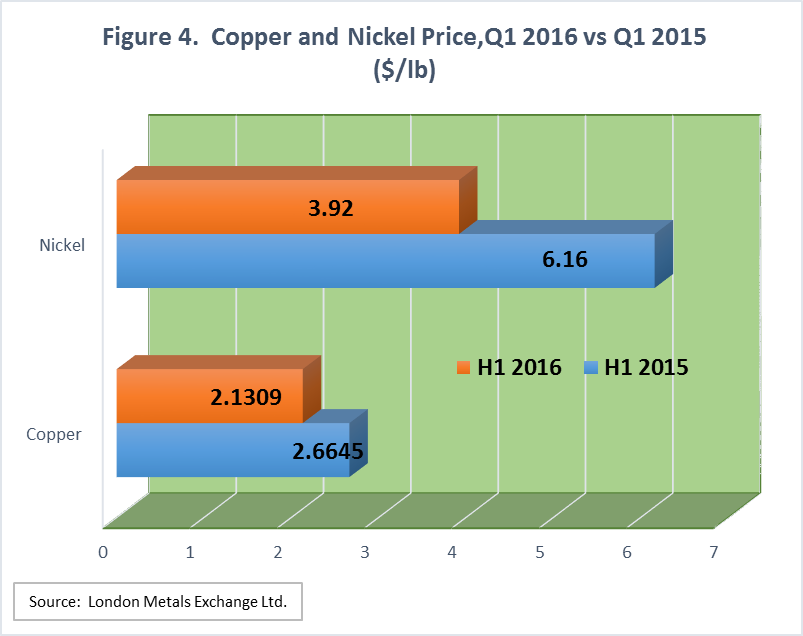

Similarly, the six-month averages for copper and nickel also went down by 20% and 36%, respectively. Copper slipped from $2.66 to $2.13 per pound, while nickel went down substantially from $6.16 to $3.92 per pound year-on-year, lower by $2.24 per pound.

On the other hand, precious metal gold was slightly up by almost 1% from $1,208.16 per troy ounce to $1,217.85 per troy ounce. During the period the gold demand from India and China, remained strong.

The outlook for the minerals industry for the second-half of 2016 and the following years remains challenging with the issuance of DMO 2016-01 or Audit of all Operating Mines and Moratorium on New Mining Projects dated 08 July 2016. The audit shall cover all operating mines and mines under suspended and/or care and maintenance status while the moratorium shall cover the acceptance, processing and/or approval of mining applications and/or new mining projects for all metallic and non-metallic minerals.

The suspension of another two (2) nickel mines in Palawan, Berong Nickel Project of Berong Nickel Corporation and Toronto & Pulot Nickel Projects of Citinickel Mines and Development Corporation is expected to further contribute to the overall sluggish performance of the metallic sector in 2016.

Noteworthy, the Department of Environment and Natural Resources, headed by Secretary Regina P. Lopez announced on 27 September 2016 the result of the mine audit conducted as per DMO 2016-01. The audit recommended the suspension of some 20 metallic mines, as follows:

1. Filminera Resources Corporation

2. Lepanto Consolidated Mining Company

3. Benguet Corporation

4. OceanaGold Phils., Inc.

5. Krominco, Inc.

6. Strongbuilt Mining Development Corporation

7. Carrascal Nickel Corporation

8. Marcventures Mining and Development Corporation

9. CTP Construction and Mining Corporation

10. Hinatuan Mining Corporation

11. Adnama Mining Resources, Inc.

12. Agata Mining Ventures Incorporated

13. SR Metals, Incorporated

14. Sinosteel Philippines HY Mining Corporation

15. Oriental Synergry Mining Corporation

16. Wellex Mining Corporation

17. Century Peak Corporation – Esperenza and Casiguran Nickel Projects

18. Oriental Vision Mining Philippines Corporation

19. Libjo Mining Corporation

20. AAM-Phil Natural Resources Exploration and Development Corporation – Parcel 1 and Parcel 2B

To summarize the composition of the above list in terms of minerals being produced: three (3) gold with silver mines; one (1) copper with gold and silver mine; two (2) chromite mines; and 14 nickel mines with the following location, three (3) in Surigao del Sur, two (2) in Surigao del Norte, two (2) in Agusan del Norte and seven (7) in Dinagat Islands.

Should the recommended suspension ensue, the possible impact of the suspension is decline in mineral production, lower taxes collected and increase number of displaced mine workers.

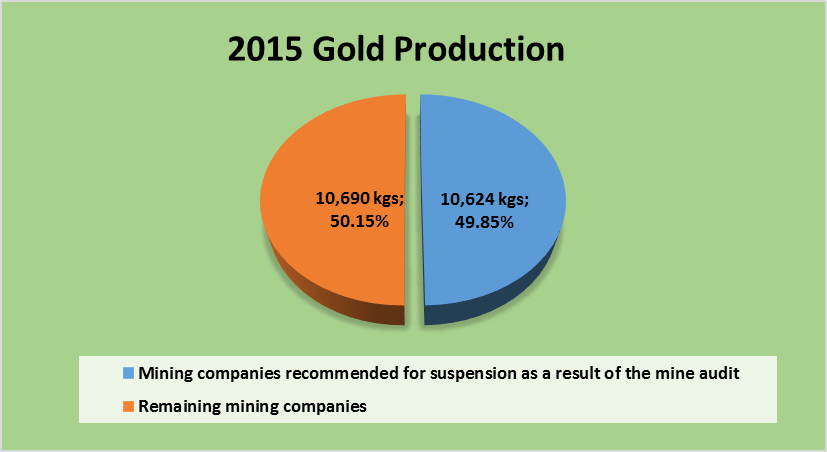

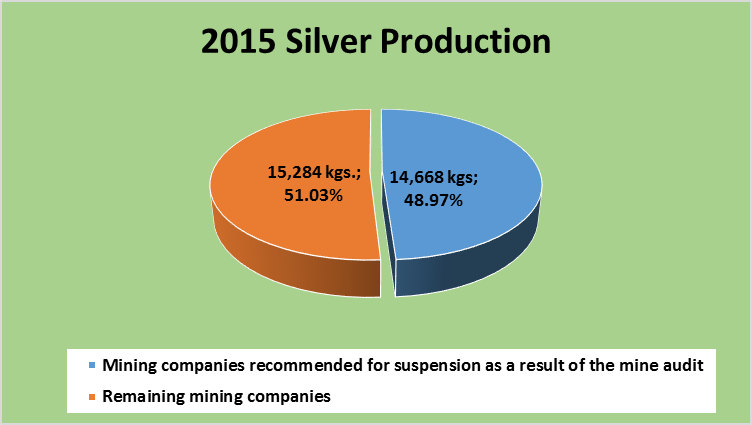

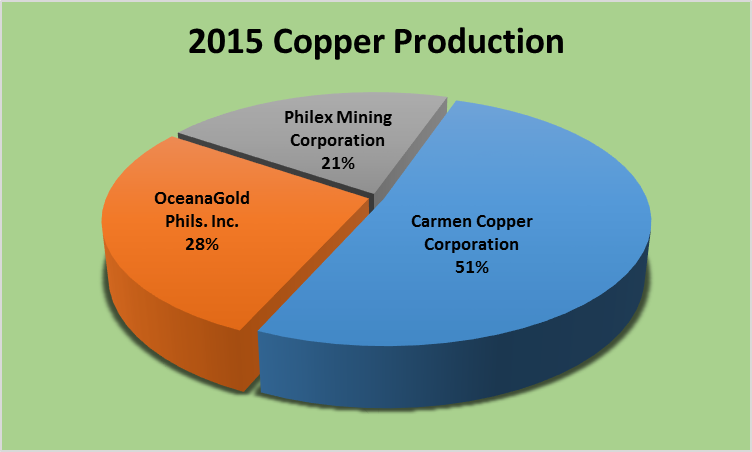

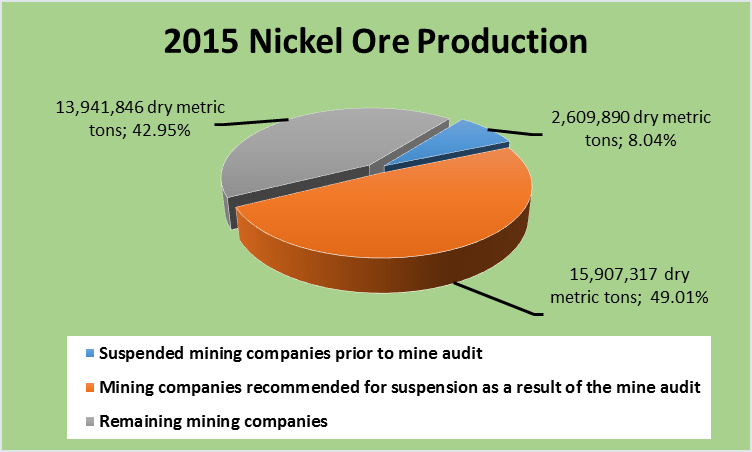

Based on 2015 data, in terms of mineral production the following will be the estimated decline:

• Gold production – Masbate Gold Project of Filminera Resources Corporation and Didipio Gold Project of OceanaGold Phils. Incorporated accounted for 26% or 5,470 kilograms and 18% or 3,809 kilograms of the total gold produced, respectively. Filminera and OceanaGold reported the highest gold production in 2015.

• Silver production - Didipio Gold Project of OceanaGold Phils. Incorporated and Masbate Gold Project of Filminera Resources Corporation accounted for 29% or 8,621 kilograms and 14% or 4,309 kilograms of the total silver produced, respectively. OceanaGold and Filminera reported the highest silver production in 2015. Combined production of Lepanto Consolidated Mining Company and Benguet Corporation was 2,425 kilograms or 5.80% of the overall silver production.

• Copper production - there are only three (3) mines producing copper and production for 2015 was distributed accordingly: Carmen Copper Corporation accounted for 51% or 173,297 dry metric tons; OceanaGold Phils. Inc. with 28% or 93,900 dry metric tons; and Philex Mining Corporation with 21% or 69,988 dry metric tons. With these statistics, it is expected that more than one-fourth or 28% of the total copper mine production will be the cutback from the annual production if the suspension of OceanaGold Phils. Inc. come to pass as recommended in the mine audit.

• Nickel ore production – combining the mine output of the suspended nickel mines prior to the mine audit and the mining companies recommended for suspension as a result of the mine audit will post risk of losing temporarily more than half or 57% in the annual total nickel mine production. Only five (5) nickel mines will be operating, namely: Rio Tuba Nickel Mining Corporation; Cagdianao Mining Corporation; Taganito Mining Corporation; Platinum Groups Metals Corporation; and Pacific Nickel Phils., Incorporated.

Taxes and fees collected both at the national and local levels is also expected to diminish. The national taxes and fees are collected by the Bureau of Internal Revenue, Bureau of Customs and the Mines and Geosciences Bureau. The local taxes and fees are paid directly to the local government treasurer.

Payments to the national government include excise tax, income tax, customs duties and fees, value added tax on imported equipment, goods and services, royalties on minerals extracted from mineral reservations, if applicable which is 5% of the actual market value of the minerals produced are just among the taxes being paid by the company.

Payments to the local governments include local business tax, real property tax, occupation fees, community tax and other local taxes imposed by the LGU.

Other payments being made by the mining companies like royalties to indigenous cultural communities, if any.

Ultimately, it is a question of ensuring the following factors: getting the utmost economic benefit from the mining operations; social community development empowerment; and preservation of the environment thru progressive rehabilitation.

To quote Undersecretary Mario L. Jacinto, Concurrent Mines and Geosciences Director: "Mining can only be responsible if the development of the country's mineral resources will be on the basis of technical feasibility, environmental sustainability, social acceptability, and financial viability. The absence of one will not render the project responsible."

By: Mineral Economics, Information and Publication Division