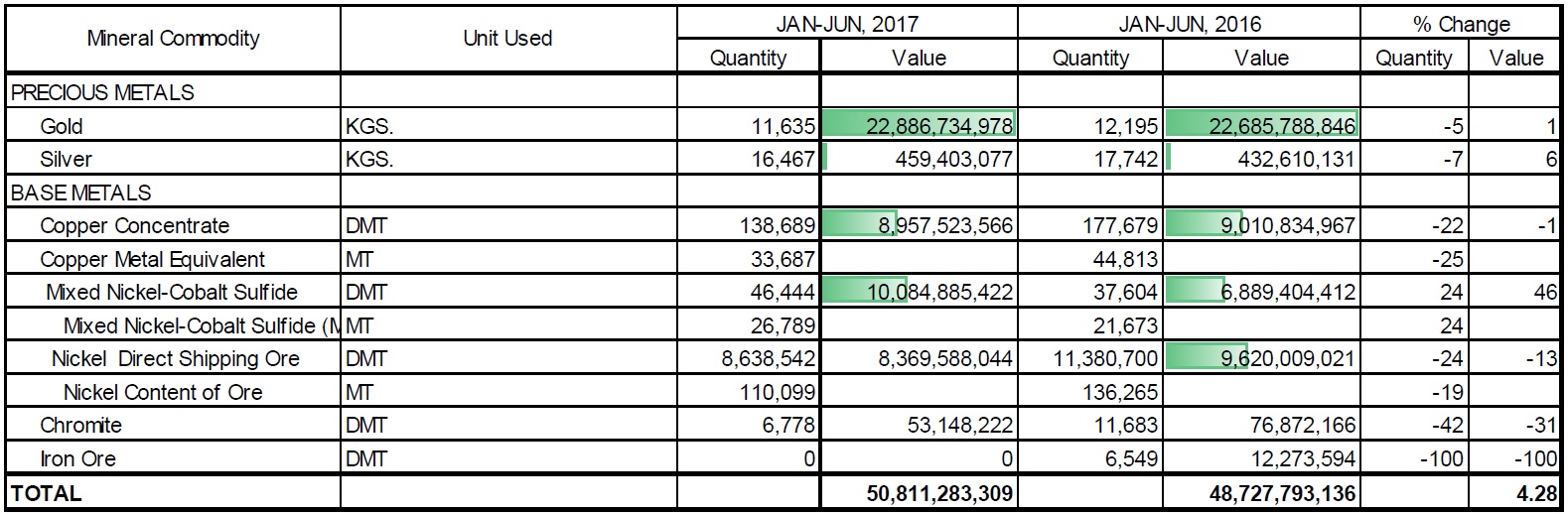

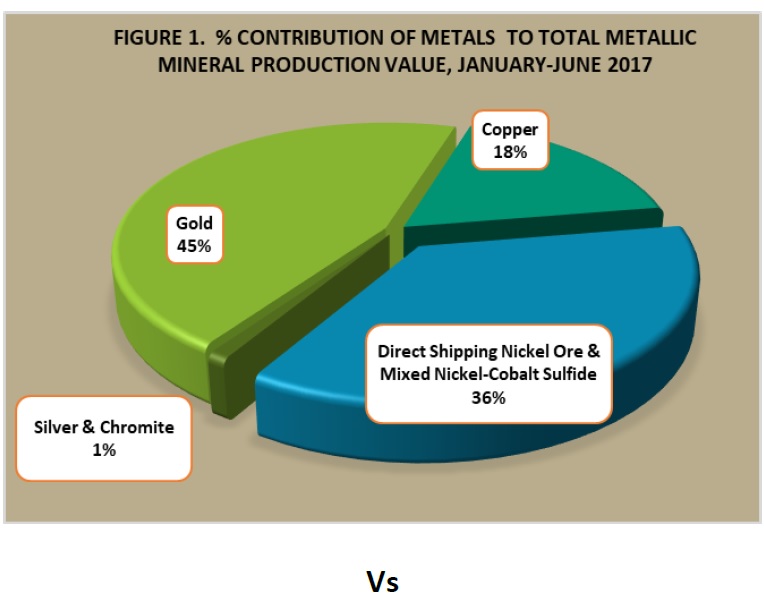

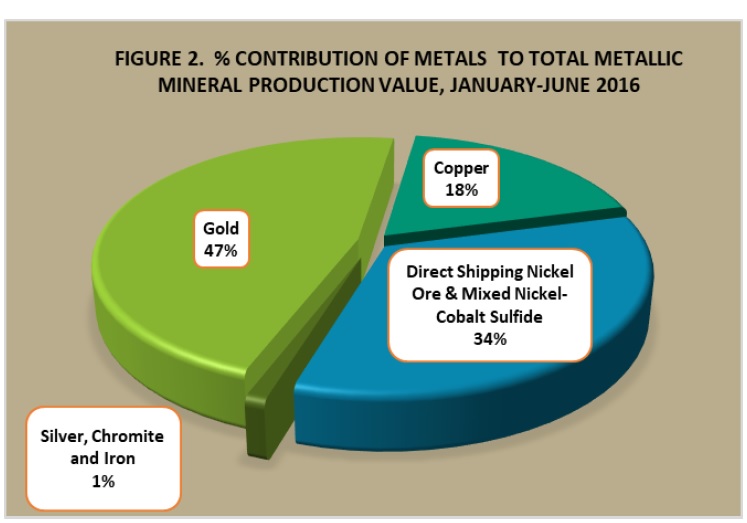

Total metallic production value sustained its growth in H1 2017 with a 4.28% or PhP2.08 billion gain, from PhP48.73 billion in H1 2016 to PhP50.81 billion.

In terms of contribution to the total metallic value, gold still ruled over the other metals, accounting for 45.04%, or PhP22.89 billion. Nickel direct shipping ore and mixed sulfides took the second spot with 36.32%, or PhP18.45 billion, followed by copper with 17.63%, or PhP8.96 billion. The remaining 1.01%, or PhP0.51 billion, was shared by silver and chromite.

Masbate Gold Project of Filminera Mining Corporation/Philippine Gold Processing and Refining Corporation in Bicol Province and OceanaGold Philippines, Inc. in Cagayan Province were the country’s major gold producers. Both accounted for about 56%, or 6,471 kilograms, of the 11,635 kilograms of gold produced in H1 2017.

With the exception of mixed nickel-cobalt sulfide (MNCS), all the rest of the metallic minerals exhibited lower mine output year-on-year. MNCS output went up by 24%, or 8,840 dry metric tons, from 37,604 dry metric tons to 46,444 dry metric tons, year-onyear. Of the two hydrometallurgical processing plants (HPAL), Taganito HPAL Project in Surigao del Norte contributed 28,182 dry metric tons, or almost 61% of the total; while Coral Bay HPAL Project in Palawan added the remaining 39%.

Chromite posted the largest deficit with 42%, from 11,683 dry metric tons in H1 2016 to only 6,778 dry metric tons in H1 2017. Techiron Resources, Inc. (TRI) located in Eastern Samar was the lone chromite producer during the period. TRI is the operator of Chromiteking, Inc. (CI), with Mineral Production Sharing Agreement (MPSA) number 292- 2009-VIII (Amended B). The 1,500-hectare portion is a partial assignment of the contract area under the MPSA from Cambayas Mining Corporation to CI approved in April 2016.

Nickel direct shipping ore, on the other hand, suffered a 24% setback, from 11.38 million dry metric tons to 8.64 million dry metric tons, lower by 2.74 million dry metric tons. Third in line was copper with a decrease of 22%, or 38,990 dry metric tons. Precious metals gold and silver also reported the same fate with a decrease of 5% and 7%, respectively (Please refer to Table 1).

The lackluster performance of nickel direct shipping ore was due to the following factors: 1) suspension of mining operations following the sanctions imposed by the Mines and Geosciences Bureau (MGB)-Department of Environment and Natural Resources (DENR) due to environment-related issues and concerns; 2) zero production due to maintenance/care status by a number of nickel mines; and 3) unfavorable weather condition during the period. Eleven mining projects reported no production during the review period.

Similarly, copper production was sluggish with all the country’s three copper mines reporting production cutback. Total production went down from 44,813 metric tons to 33,687 metric tons year-on-year, down by 24.83% or 11,126 metric tons. Among the three copper mines, namely: Padcal Copper Gold Project of Philex Mining Corporation; Didipio Copper-Gold Project of OceanaGold Philippines, Inc.; and Toledo Copper Operations of Carmen Copper Corporation, it was Toledo Copper Operations located in Cebu that incurred the largest drop at 33%.

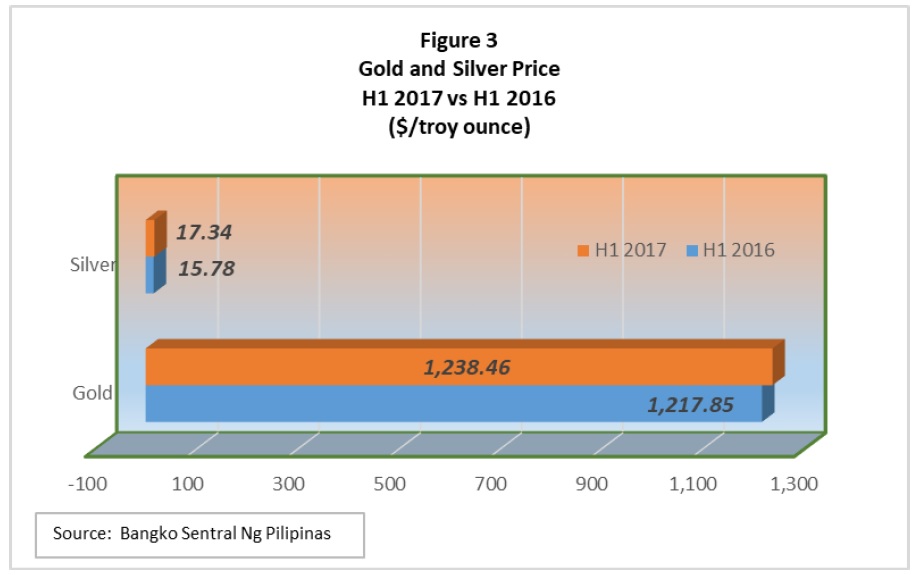

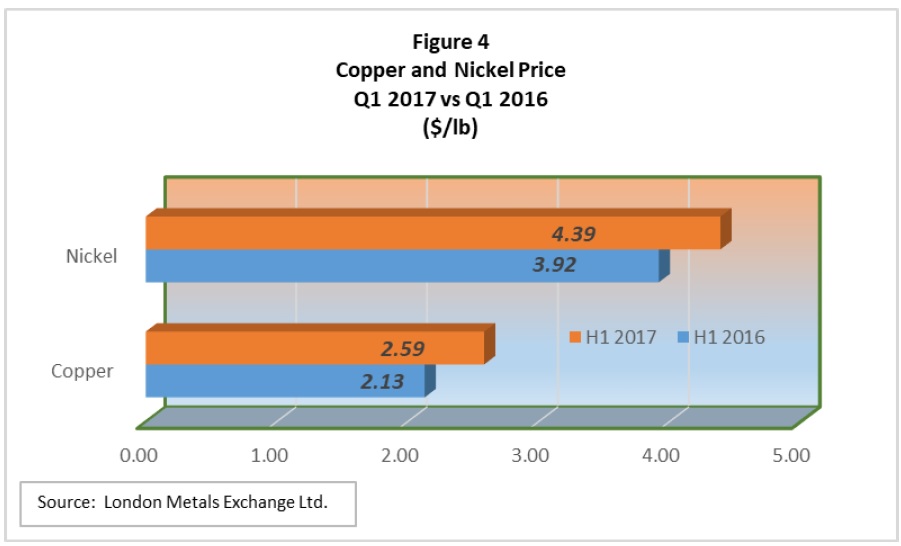

The upside during the period, despite the listless mine output of the metals with the exemption of MNCS, was the more favorable metal prices year-on-year.

The average price of copper grew by 21.32%, from $2.13 per pound to $2.58 per pound. Nickel ore went up from $3.92 per pound to $4.39 per pound (Refer to Figure 4), while precious metals gold and silver enjoyed an improvement of 1.69% and 9.91%, respectively (Refer to Figure 3). Experts said that prices were primarily driven by stronger demand from China’s infrastructure and manufacturing sectors. This was reinforced by the supply disruptions from the world’s key copper and nickel mines. Gold price was on the upswing in H1 2017 particularly due to strong investment demand. The yellow metal was upbeat at US$1,238.46 per troy ounce in H1 2017, from US$1,217.85 per troy ounce year-on-year, a US$20.61 increase.

In the local front, the MGB has strengthened its mine monitoring activities in the Caraga Region by creating teams to conduct quarterly monitoring of mining operations, specifically in Region XIII. To make monitoring more systematic and comprehensive, the MGB came up with new checklists summarizing the environment, safety, social and mining tenement obligations of mining companies. Said undertaking is in response to the President’s directive to the mining industry to follow the rule of law. Of the 50 operating metallic mines in the country, 24 are located in Caraga, namely: two gold mines, one chromite, and 21 nickel.

Also, in response to the President’s directive for the mining industry to strictly follow mining laws and regulations, especially on the protection of the environment, DENR Secretary Roy A. Cimatu issued Memorandum Order No. 2017-309 on 14 July 2017, directing all MGB Regional Directors to implement the following:

- Strict and continuous monitoring of mining operations in accordance with the standards set forth under the existing mining and environmental laws, rules and regulations, particularly on the environmental, social and safety provisions thereof;

- Conduct of immediate investigation and imposition of appropriate penalties and sanctions on violations committed; and

- Immediate implementation of appropriate remediation/rehabilitation of adverse effects/damages, including the prompt assessment and payment of compensation to the affected individual/s.

Table1. Philippine Metallic Mineral Production, H1 2017 vs H1 2016