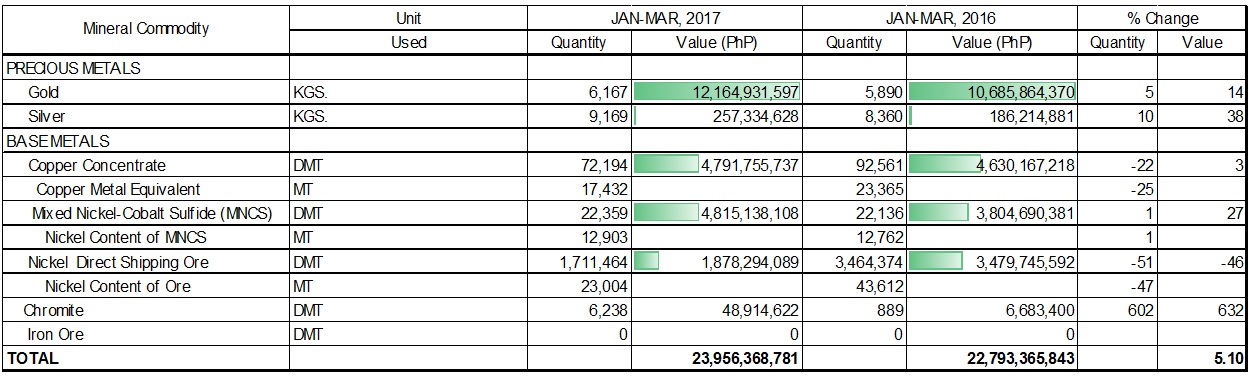

Philippine metallic mineral production value grew by 5.10% in Q1 2017 from PhP22.79 billion in Q1 2016 to PhP23.96 billion, an increase of PhP1.16 billion.

The good performance of gold and mixed nickel-cobalt sulfide (MNCS) were the drivers for this positive turnout. Production value of gold and MNCS went up by PhP1.48 billion and PhP1.01 billion, respectively.

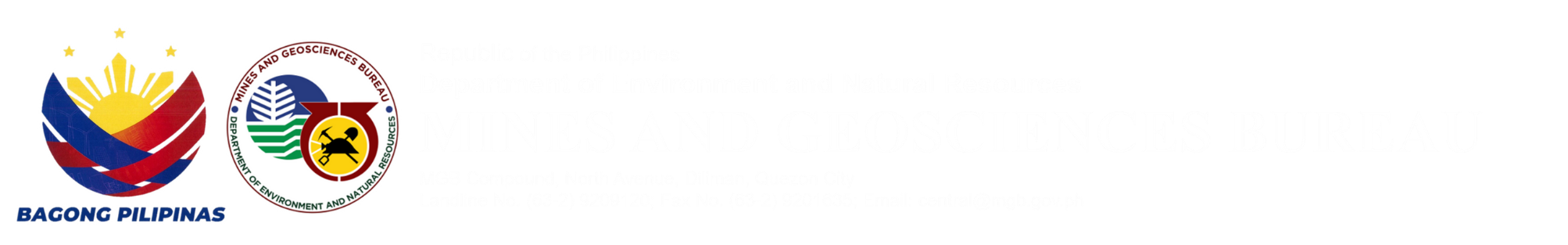

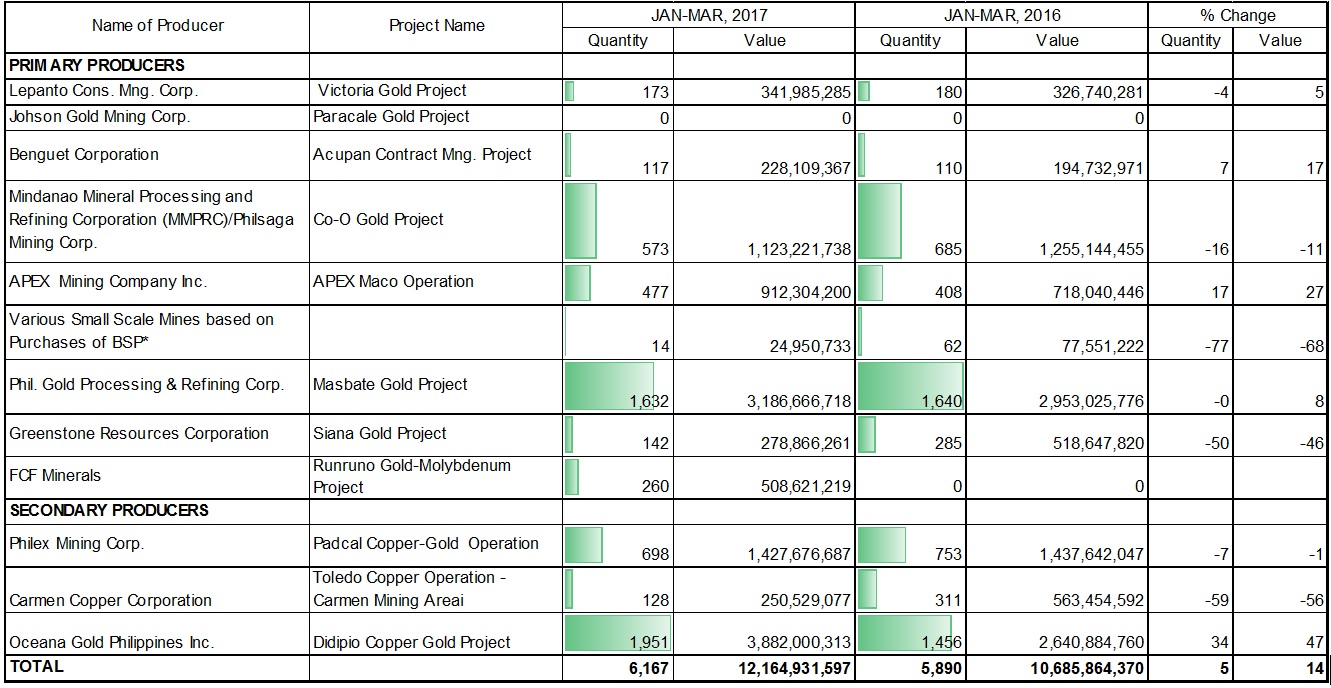

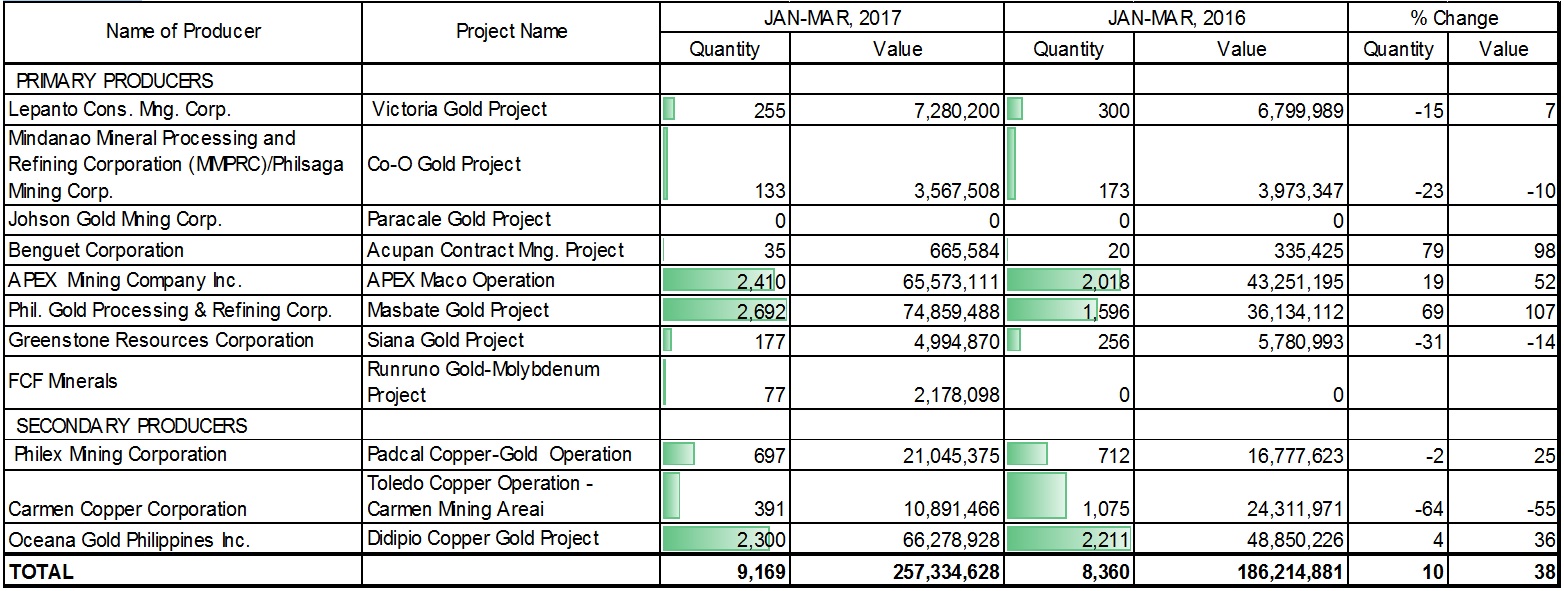

In terms of contribution to the total metallic mineral production value, gold validated its dominance over the other metals with 51%, or PhP12.16 billion, input during the review period. The Didipio Gold Project of OceanaGold Philippines Inc. (OGPI) in Nueva Vizcaya and Masbate Gold Project of Filminera Mining Corporation/Philippine Gold Processing and Refining Corporation in Masbate were at the forefront with 1,951 kilograms and 1,632 kilograms, respectively (See Table 2). The combined gold output of the two Projects accounted for more than 58%, or PhP7.07 billion, of the country’s gold production value.

In terms of mining method, among the country’s six gold mines, only Runruno Gold-Molybdenum Project of FCF Minerals Corporation (FMC) in Nueva Vizcaya conducts open-pit mining while the rest use underground mining. FMC is the second mining company to be granted a Financial or Technical Assistance Agreement (FTAA) by the government.

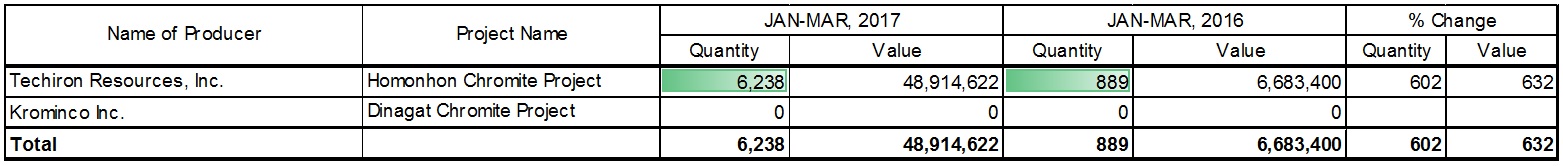

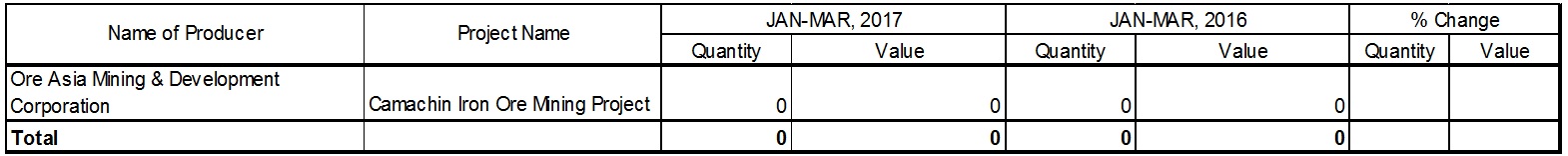

The collective output of direct shipping nickel ore and mixed nickel-cobalt sulfide took the second spot with 28%, or PhP6.69 billion share, while copper came in close second with 20%, or PhP4.79 billion. The remaining 1%, or PhP0.31 billion, came from the aggregate value of silver and chromite (See Figure 1). Ore Asia Mining and Development Corporation in Bulacan reported zero iron ore production during the period.

It is important to note that, from 2012-2015, the joint production value of nickel direct shipping ore and mixed nickel-cobalt sulfide consistently took the top spot with a four-year average of about 49% of the total metallic production value. The highest recorded contribution made by nickel was in 2014 at 60%, or PhP85 billion. However, gold bested nickel in 2016 and 2017 due to a sequence of mine operation suspensions in nickel mines in Zambales and Palawan.

Out of the 28 nickel mines, 21 reported zero production and only seven reported production in Q1 2017. Zero production was due to the following reasons: (1) unfavorable weather conditions/intermittent rains; (2) under maintenance/care status; and (3) suspended operations due to environmental related issues. A nickel mining operation, being surface mining, is always vulnerable to the weather condition. In Surigao and Dinagat Islands, rains come in the months of January, February, March, October, November and December, with January being the wettest month. About 19 nickel mines are located in Surigao and Dinagat Islands.

The nickel direct shipping ore incurred deficit in both production volume and value, with setbacks of 47% and 46%, respectively; from 43,612 metric tons with estimated value of PhP3.48 billion in Q1 2016 to 23,004 metrics tons with estimated value of PhP1.88 billion in Q1 2017 (See Table 8).

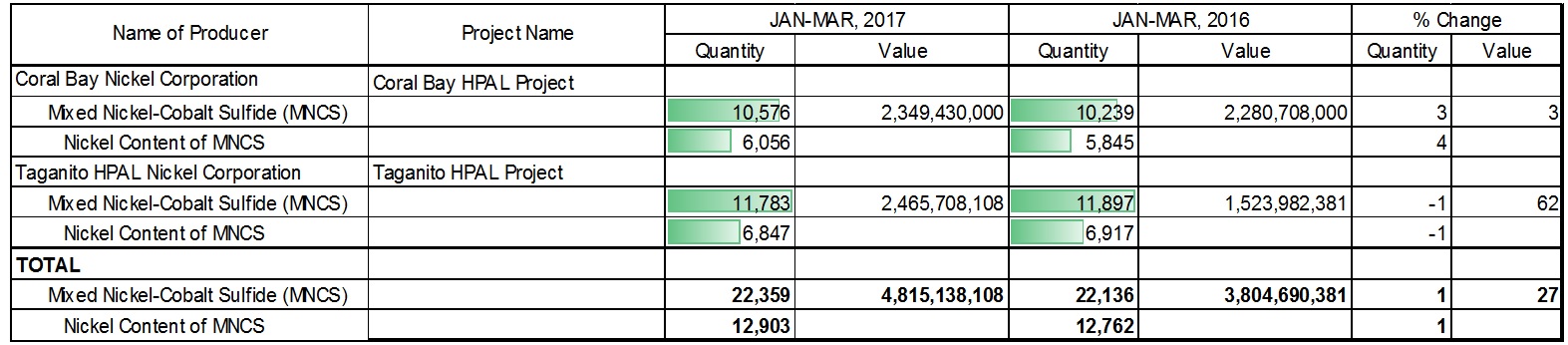

In Q1 2017 Coral Bay Nickel Corporation (CBNC) and Taganito HPAL Nickel Corporation (THPAL) produced 6,056 metric tons and 6,847 metric tons, respectively of mixed nickel-cobalt sulfide. The total output value of the two plants was PhP4.82 billion, 27% higher than the PhP3.80 billion year-on-year (See Table 7). CBNC and THPAL are the only hydrometallurgical nickel processing plants in the country commissioned in 2005 and 2013, respectively. Mixed nickel-cobalt sulfide is the main product of the said plants.

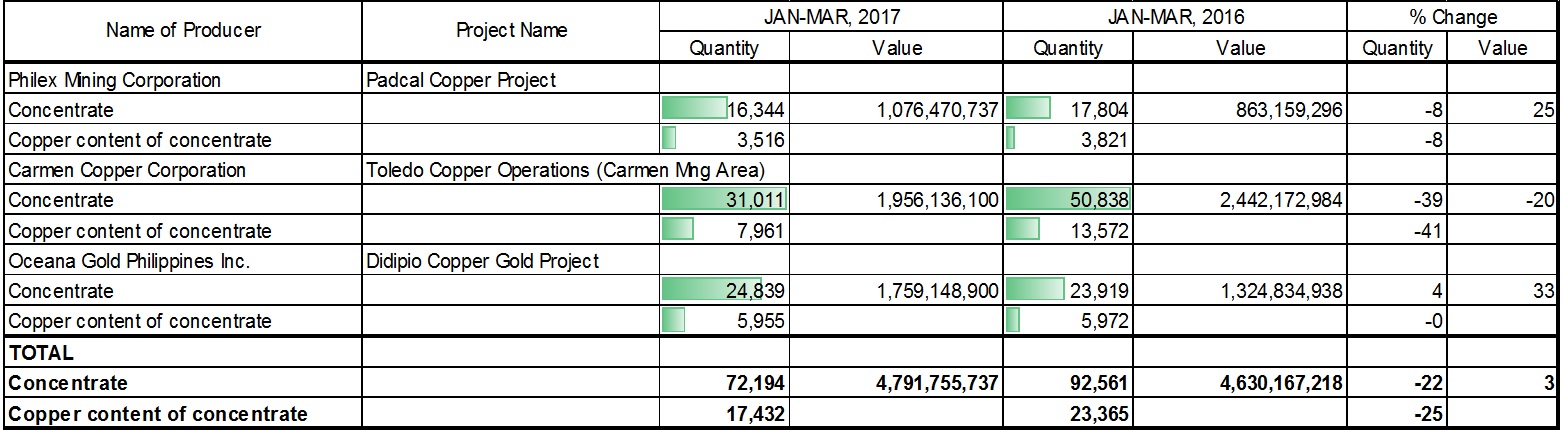

In terms of copper production, Carmen Copper Corporation reported the largest output with 46%, or 7,961 metric tons, in Q1 2017. The country has three copper mines namely: (1) Padcal Copper-Gold Project of Philex Mining Corporation in Benguet, which is an underground mine; (2) Toledo Copper Operations of Carmen Copper Corporation in Cebu, an open-pit mine; and (3) Didipio Copper-Gold Project of OGPI in Nueva Vizcaya, also an open-pit mine. OGPI is the very first mining company to be granted an FTAA by the government.

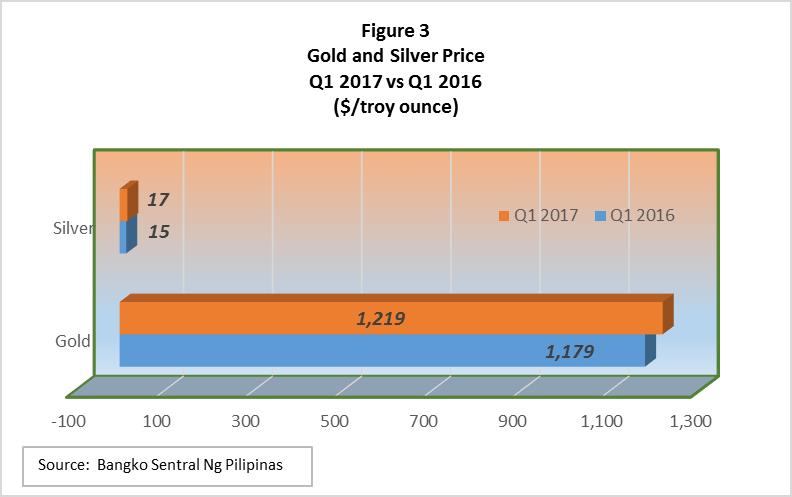

In terms of metal prices, precious metals gold and silver, and the base metals copper and nickel, were robust during the review period. The average price of the yellow metal was up by 3.36%, from $1,178.92 per troy ounce in Q1 2016 to $1,218.54 per troy ounce in Q1 2017 (See Figure 3). Similarly, the white metal closed the first quarter with an average of $17.41 per troy ounce from $14.84 per troy ounce, a growth of 17.34% year-on-year.

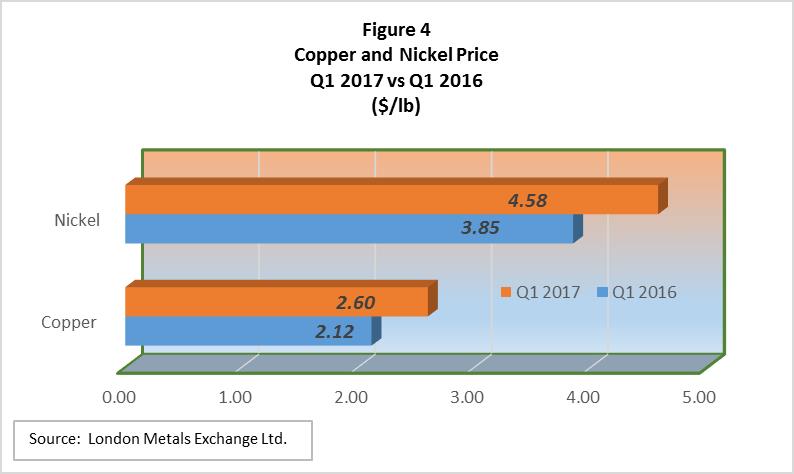

In the same way, the three-month averages for nickel and copper also increased by 19.03% and 22.88%, respectively. Nickel went up from $3.85 to $4.58 per pound while copper rose from $2.12 to $2.60 per pound year-on-year (See Figure 4).

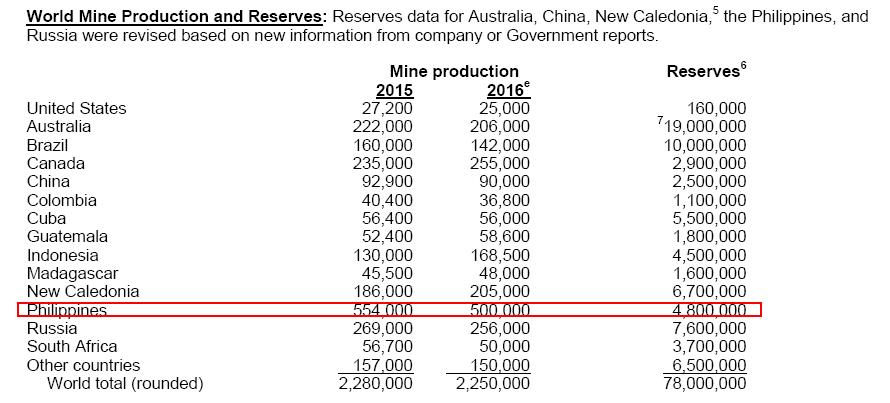

In the international front, the Philippines has always been regarded as one of the major nickel producers in the world. The Mineral Commodity Summaries 2017, a United States Geological Survey publication, showed that the Philippines ranked first in terms of estimated mine nickel production in 2015 and 2016 with 554,000 and 500,000 tons, respectively. In far second and third were Russia and Canada with 256,000 and 255,000 tons, respectively. It is expected that with the recent developments in the local mining industry where a number of operations of nickel mines were suspended due to environmental related concerns, the nickel mine production of the country will likely go down (See Figure 5).

Figure 5. World Mine Nickel Production, 2015-2016 (Source: United States Geological Survey)

At the local front, three (3) new regulations related to mining were issued by then Department of Environment and Natural Resources Secretary Reginal Paz L. Lopez. These were: (1) DAO No. 2017-07, Mandating Mining Contractors to Participate in the Philippine Extractive Industries Transparency Initiative (PH-EITI), issued on 12 April 2017; (2) DENR-MO-2017-01, Exclusion of Certain Quarry Resources from the Mining Moratorium, issued on 10 March 2017; (3) DENR-AO 2017-10, Banning the Open Pit Method of Mining for Copper, Gold, Silver and Complex Ores in the Country, issued on 27 April 2017.

Table 1. Philippine Metallic Production

Table 2. Philippine Gold Production

Quantity: In Kilograms

Value: PhP

Table 3. Philippine Silver Production

Quantity: In Kilograms

Value: PhP

Table 4. Philippine Copper Production

Quantity: Concentrate in DMT

Copper content of concentrate in MT

Value: In PhP

Table 5. Philippine Chromite Production

Quantity: In DMT

Value: In PhP

Table 6. Philippine Iron Ore Production

Quantity: In DMT

Value: In PhP

Table 7. Philippine Mixed Nickel-Cobalt Sulfide Production

Quantity: Mixed Nickel-Cobalt Sulfide (MNCS) - DMT

Nickel Content of MNCS - MT

Value: In PhP

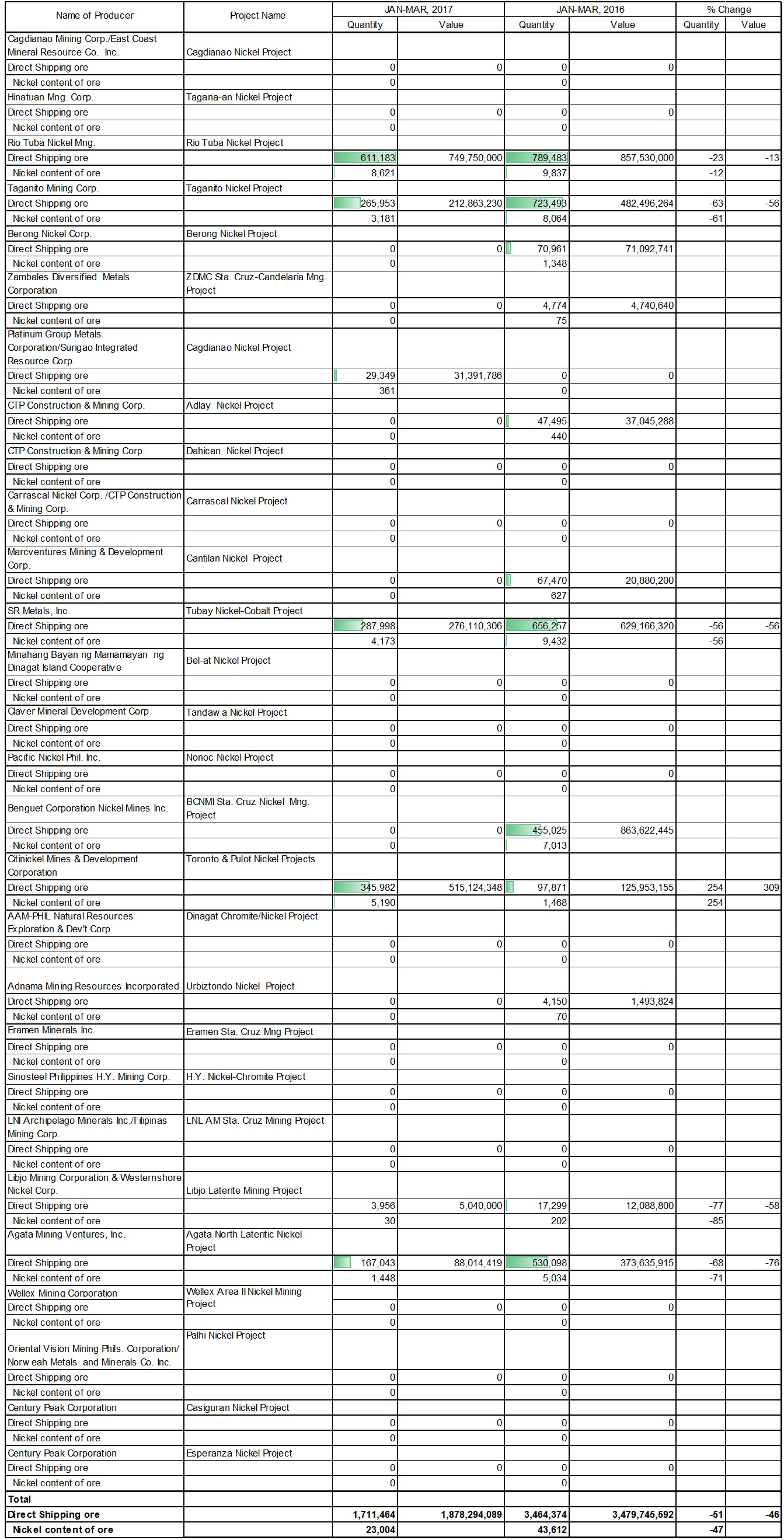

Table 8. Philippine Nickel Ore Production

Quantity: Direct Shipping Ore in DMT

Nickel content of ore in MT

Value : In PhP