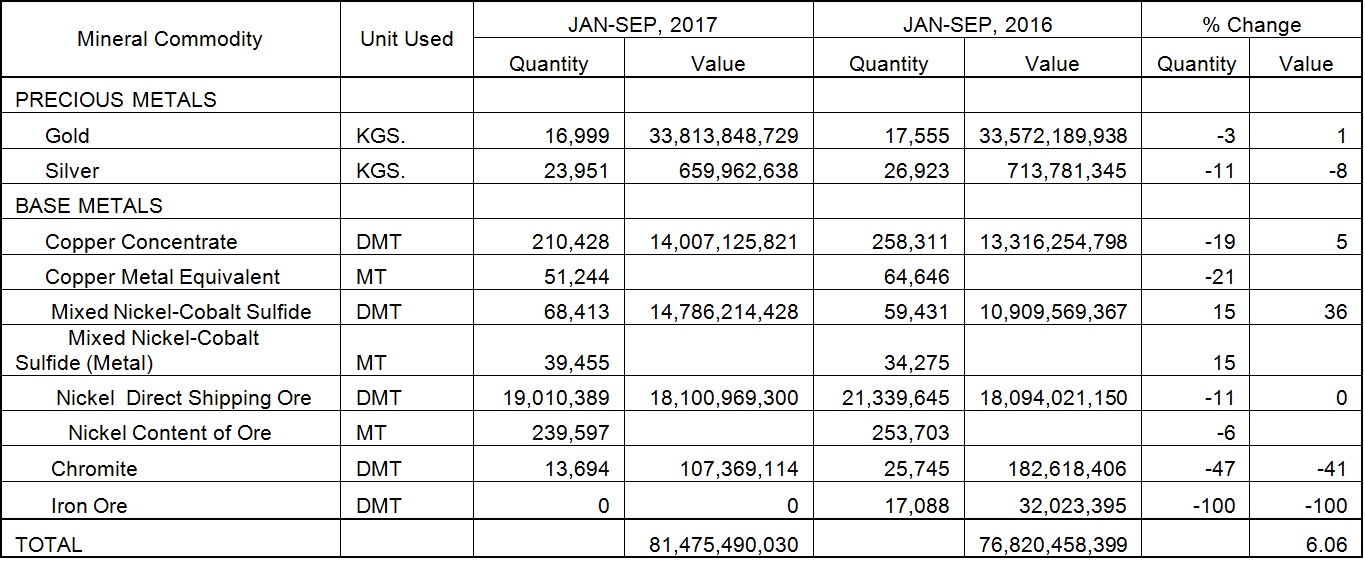

Metallic production value managed to pull a 6.06%, or PhP4.66 billion, growth from PhP76.82 billion during the first three quarters in 2016 to PhP81.48 billion during the same period this year.

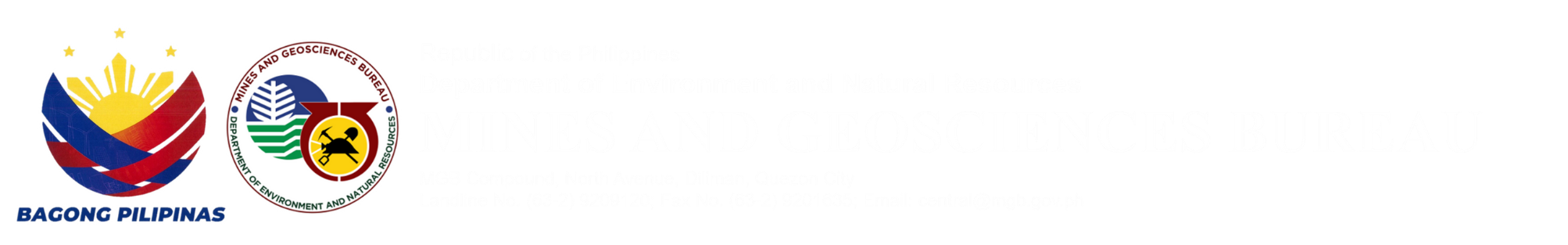

This positive turnout can be attributed to the more favorable metal price levels during the period. With the exception of the yellow metal, which went down by almost US$5.00 from US$1,256.71 per troy ounce in 2016 to US$1,251.72 year-on-year, prices of base metals - copper and nickel - went up, together with the white metal. Silver reported an average price of US$17.17 per troy ounce in 2017 from US$17.05 per troy ounce in 2016.

The nine-month averages for copper and nickel stood firm at $2.60 per pound and $4.49 per pound, respectively. Copper price went up from $2.14 per pound to $2.60 per pound, while nickel enjoyed an increase from $4.17 per pound to $4.49 per pound. The encouraging price gain of base metals was primarily due to the increased metal demand of China. World metal analysts reported that the strong demand of China for said metals were for its infrastructure, automotive, and construction sectors. This they said, led to a tighter metals supply in the world market. China remains to be the major market of the Philippines for nickel ores. While for our copper and gold exports the country’s primary partners were Japan and Switzerland, respectively.

On the other hand, mine output was generally sluggish during the period, as most commodities reported production shortfall. Only mixed nickel-cobalt sulfide (MNCS) displayed positive growth at 15%, from 34,275 metric tons to 39,455 metric tons year-on-year. Coral Bay Nickel Corporation in Palawan and Taganito HPAL Nickel Corporation in Surigao Del Norte were the only producers of MNCS in the country.

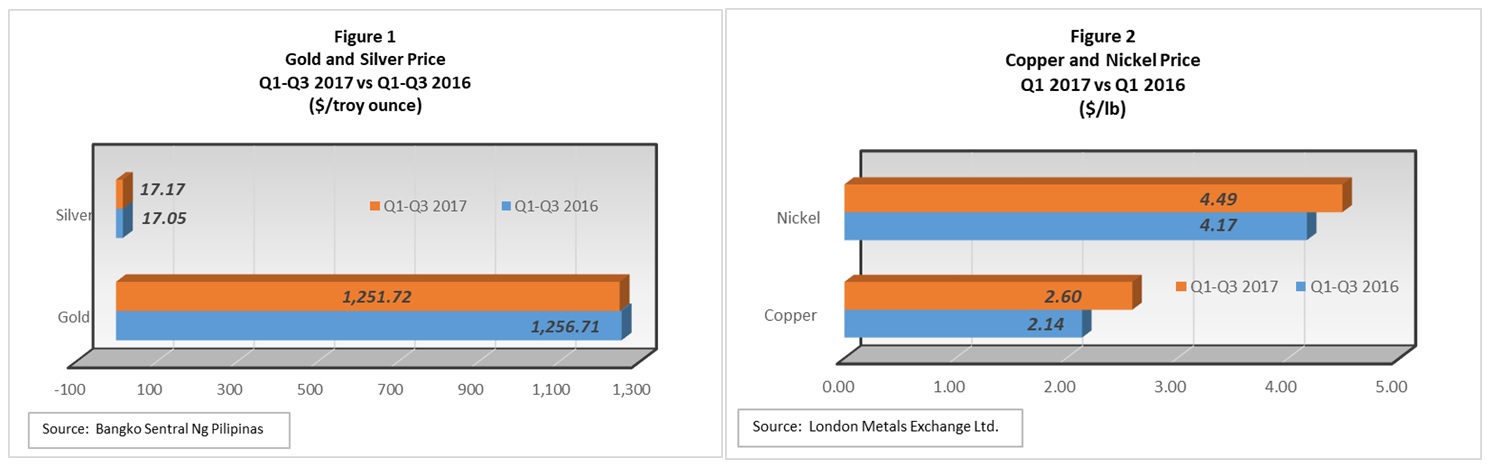

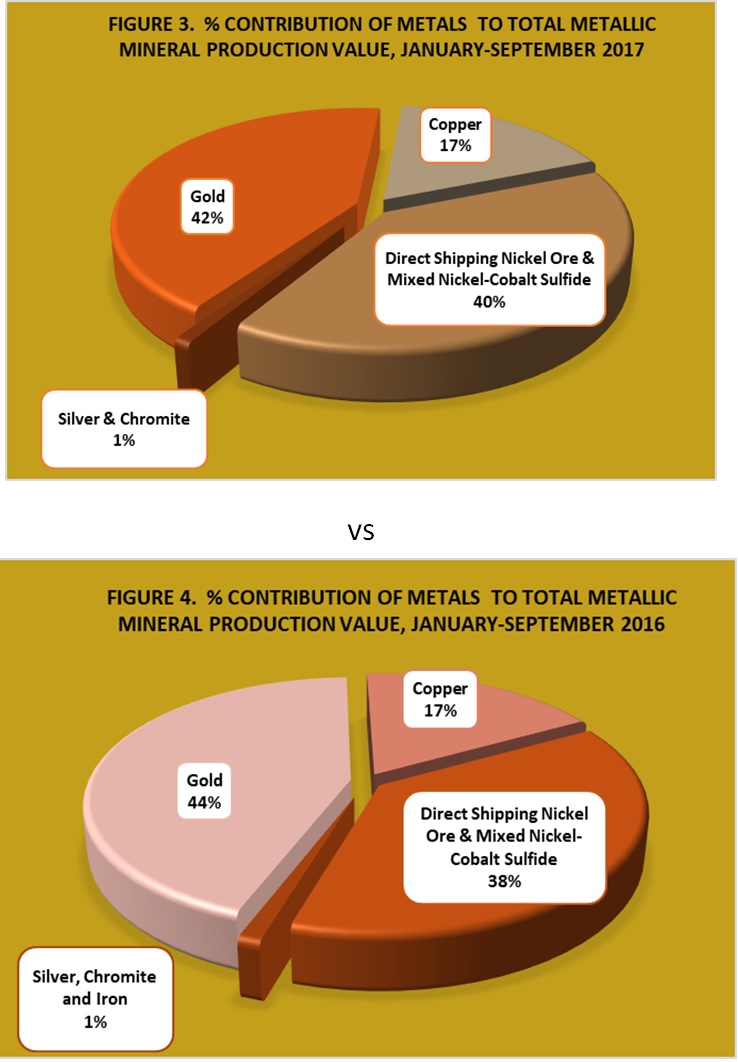

In terms of percentage contribution to the total production value, gold continued to outperform the others, accounting for 42%, or PhP33.81 billion, followed by the combined values of nickel direct shipping ore (DSO) and MNCS with 40%, or PhP32.89 billion. Copper, on the other hand, shared 17%, or PhP14.01 billion, while the remaining 1%, or PhP0.77 billion, came from the collective values of silver and chromite. While gold still dominated the production scene, it is significant to note that nickel has started to substantially narrow the gap to only PhP0.93 billion. Same period last year, in terms of contribution to the total production value, the difference of gold and nickel (DSO & MNCS) was a striking PhP4.57 billion.

For gold production, Masbate Gold Project of Philippine Gold Processing & Refining Corporation/Filminera Mining Corporation took the top spot with 4,633 kilograms with estimated value of PhP9.35 billion.

For silver production, Apex Maco Operation of Apex Mining Company Inc. led with 7,065 kilograms valued at PhP192.52 million.

Toledo Copper Operations of Carmen Copper Corporation dominated the copper production scene with 26,326 metric tons valued at PhP6.39 billion; while for nickel DSO, Claver Nickel Project of Taganito Mining Corporation reported the highest output with 38,020 metric tons valued at PhP2.19 billion.

Still on production, the Enargite Copper-Gold Project of Lepanto Consolidated Mining Corporation (LCMC) resumed its operation last September 2017. This has helped increase the copper, gold and silver production of the country. LCMC first operated a copper mine before the Victoria ore body was discovered, which was eventually referred to as the Victoria I Project. Previously, the only copper mines in the country were Padcal Copper-Gold Project of Philex Mining Corporation, Toledo Copper Operation of Carmen Copper Corporation, and Didipio Copper-Gold Project of OceanaGold (Philippines), Inc. The re-entry of LCMC-Enargite Project to the production scene is considered to be a positive development.

Meanwhile, the performance of nickel DSO continued to be hampered by the standing suspension in the operations of a number of nickel mines, coupled with the non-operation of nickel mines in Dinagat Islands due to care/maintenance status and unfavorable weather conditions.

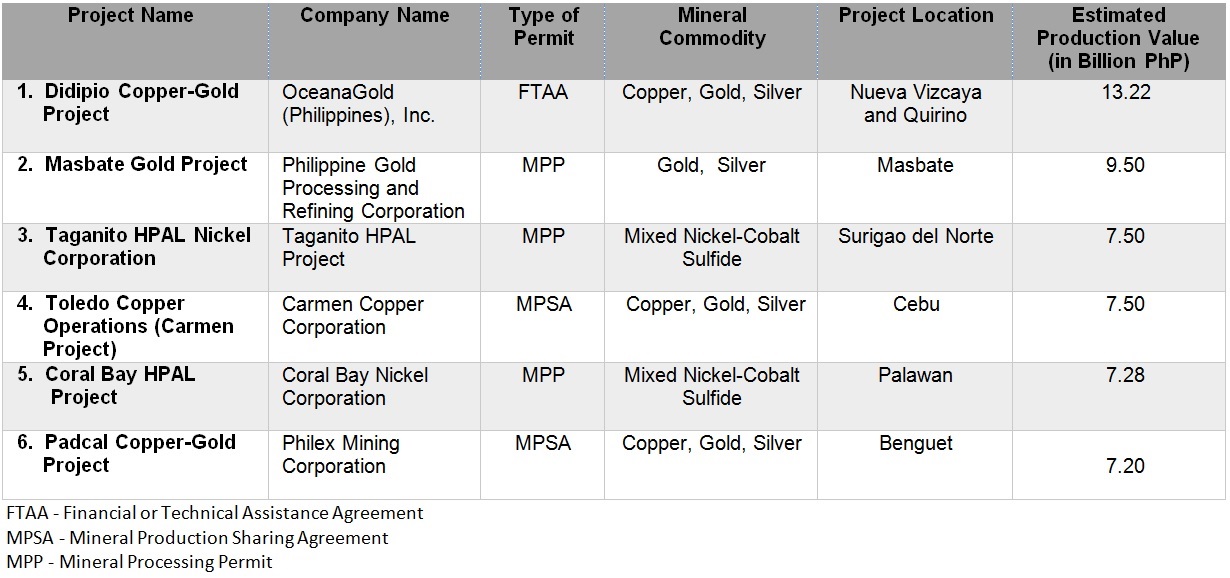

In terms of peso value, the top six mining projects, including mineral processing, from January to September 2017 were the following:

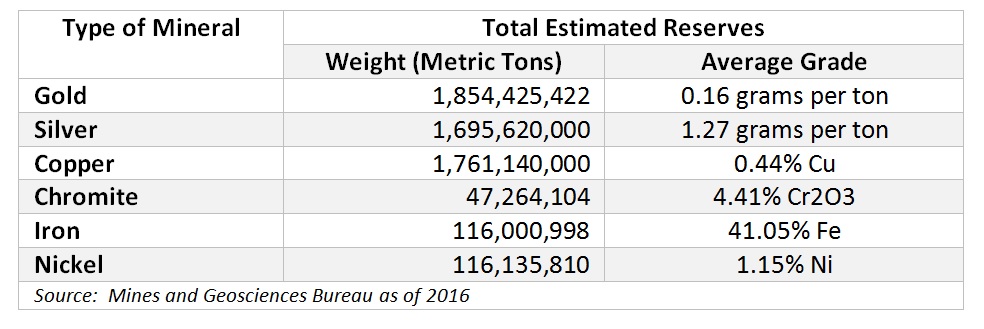

Undoubtedly, the Philippines is a well-endowed country in terms of mineral resources. With its long history and experience in mining, it has demonstrated its very rich potential for copper, gold, nickel, chromite and other metallic minerals through the commercial operation of numerous mines. Below are some of the estimated metallic reserves of the country:

To make them useful to the economy, the rich mineral resources of the Philippines have to be explored and then developed into commercial mines. Mining is both a capital-intensive and highly technical business venture.

Currently, only seven gold, four copper, one chromite, and 17 nickel mines reported production during the nine-month period. The rest reported zero production during the review period.

PHILIPPINE METALLIC MINERAL PRODUCTION

Q1-Q3 2017 vs Q1-Q3 2016

Value: In PhP